0.88 EUR to USD: Navigating the Euro-Dollar Exchange Rate

Converting 0.88 euros to US dollars isn't simply a matter of multiplication. The EUR/USD exchange rate is a dynamic figure, influenced by a complex interplay of economic and geopolitical factors. Understanding these influences is crucial for maximizing your money. This article will demystify the process, providing practical steps to secure the best possible conversion rate. For precise calculations, you can use this futures exchange rate calculator.

Decoding the Fluctuations: Why Exchange Rates Change

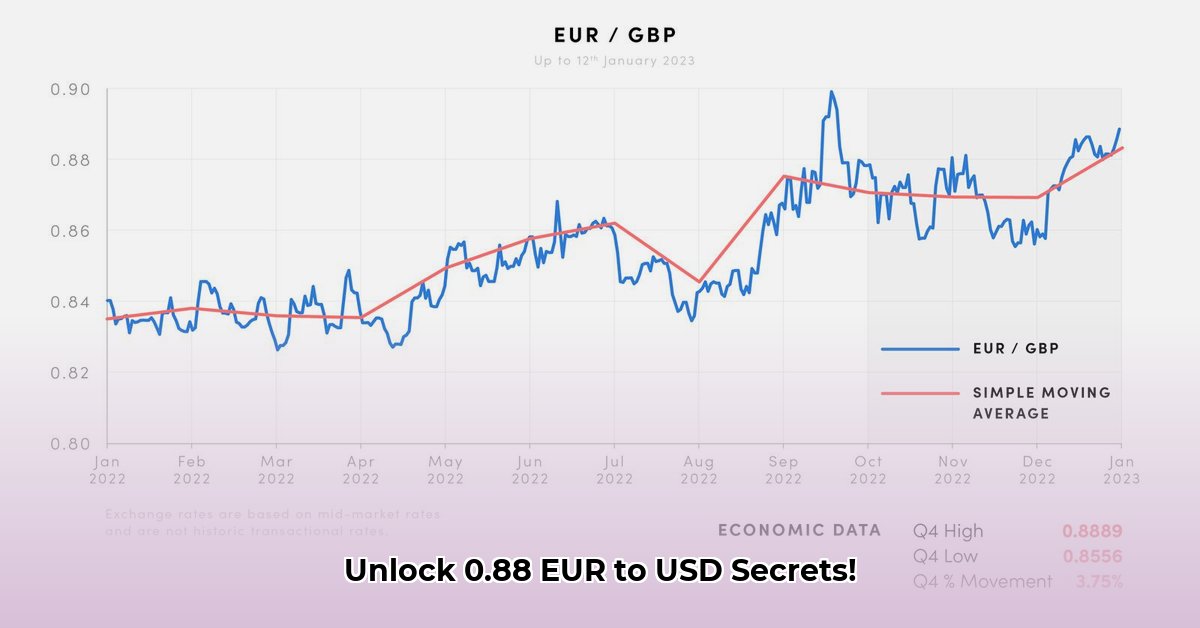

The EUR/USD exchange rate dances to the rhythm of various economic and political factors. Why does the value of 1 euro fluctuate against the dollar, from $1.03 today to potentially $1.07 tomorrow? This volatility is a fundamental aspect of the international financial market. Imagine planning a European vacation; a stronger euro against the dollar means a pricier trip, while a weaker euro extends your budget. This principle also applies to businesses engaged in international trade, impacting pricing, profits, and competitiveness.

But how exactly does this fluctuation happen? The value of a currency is fundamentally determined by supply and demand. A country's economic performance, interest rates, and political stability all contribute to investor confidence, impacting that currency's demand in the global market. A strong economy typically translates into a stronger currency. Conversely, political uncertainty can cause a currency to weaken.

Beyond Simple Multiplication: Factors Affecting the Conversion

While a simple calculation might seem sufficient, the reality is more nuanced. The official "mid-market" rate (the average exchange rate between banks) rarely reflects the actual rate you receive from banks or online money transfer services. These institutions add fees and a "spread" (the difference between the buying and selling rate) to their exchange rates. Converting your 0.88 EUR to USD might therefore yield less than a straightforward calculation.

This is why comparing offers from different providers is crucial. A seemingly favorable exchange rate might be counteracted by hefty transaction fees, negating any apparent savings.

The Key Players: Influencers of EUR/USD Exchange Rates

Several factors influence the EUR/USD exchange rate, making it a constantly shifting target:

- Interest Rates: Higher interest rates in one country attract foreign investment, thereby increasing the demand for that country’s currency.

- Inflation: High inflation erodes a currency’s purchasing power, diminishing its relative value.

- Economic Growth: Strong economic growth usually bolsters a country’s currency, while economic downturns can weaken it.

- Geopolitical Events: International conflicts, political instability, and unexpected market events can significantly influence investor sentiment and exchange rates.

Securing the Best Rate for Your 0.88 EUR: A Practical Guide

To ensure you get the most for your 0.88 EUR, follow these steps:

- Research: Compare rates from different providers, including banks, online money transfer services, and credit unions. Don't solely focus on the headline exchange rate; consider all associated fees.

- Compare Fees: Analyze transaction fees, transfer fees, and any other charges. A seemingly lower exchange rate might be offset by higher fees.

- Security: Prioritize secure and reputable providers. Check their security protocols, customer reviews, and licensing.

- Transfer Speed: Consider the transfer time. Some services expedite the process, while others may take longer.

- Transparency: Choose a provider with clear and transparent fee structures. Avoid hidden charges.

By following these steps, you can navigate the complexities of currency conversion and ensure you receive the best possible rate for your 0.88 EUR.

"Choosing the right money transfer service is vital to maximizing your return," says Dr. Anya Sharma, Financial Analyst at the Global Economics Institute. "Comparing exchange rates and fees across multiple providers is crucial before making a decision."

Avoiding High Fees: Smart Strategies

Many options exist for converting currency, each with its own cost implications:

- Banks: Generally offer competitive rates but might have minimum transaction amounts or processing times.

- ATMs: Convenient but may incur significant fees from both your bank and the foreign ATM network.

- Online Money Transfer Services: Often provide competitive rates and transparent fees.

- Currency Exchange Counters: Typically charge exorbitant fees – avoid unless unavoidable.

Key Takeaway: Avoid airport kiosks and currency exchange desks, which tend to have drastically inflated fees. Prioritize your home bank (if they provide competitive exchange rates) or reputable online money transfer services for the best results.

Note: Exchange rates are constantly changing. Always verify the most up-to-date figures before any transaction. This article aims to provide an overview and should not be considered individualized financial advice. Consult with a financial professional for personalized guidance.